TABLE OF CONTENTS

The aerospace industry is experiencing significant growth and is projected to reach $1 trillion by 2030. Several factors fuel this growth, including the rise of NewSpace companies, commercial solutions, increased private investment, and technological advancements.

NewSpace companies are private companies developing innovative, cost-effective space exploration and commercialization technologies. These space startups are producing less expensive launch vehicles, bigger satellite constellations, and space tourism ventures, opening up new avenues for exploration and commercialization.

NewSpace is a growing space industry sector that focuses on commercializing space through new technologies. Space startups are lowering the cost of launching payloads into orbit by developing smaller, more efficient satellites and using cost-effective business models like ride-sharing and data-as-a-service (DaaS).

This shift has opened space exploration to a wider range of players and created diverse revenue streams within the space value chain. NewSpace has also created new revenue streams, including space tourism and asteroid mining. This article will highlight the aerospace trends shaping the space industry and explore the rise of NewSpace companies and the technologies they are producing.

NewSpace companies are making satellites smaller

The miniaturization of satellites in low earth orbit reduces long-term costs. Smaller rockets flying at lower altitudes need less fuel, have simpler structures, and are cheaper to manufacture than larger rockets flying at higher altitudes. These bigger rockets carry many smaller satellites, allowing more paying customers to share the costs of engineering, building, and launching.

Gilmour Space Technologies develops small-lift launch vehicles to space more accessible for smaller aerospace companies and organizations developing compact satellites. Gilmour Space encourages the development and deployment of more versatile tools for applications such as Earth observation, communication, and scientific research by focusing on the small satellite market and offering affordable and reliable launch services.

The growth of LEO (Low Earth Orbit)

Technological advancements like additive manufacturing, digital engineering, and AI, and the acceleration of broadband satellite constellations, which decrease the cost-per-kg to orbit, global competition, and US government are providing the foundation for LEO growth.

LEO satellites offer advantages over their higher-orbit counterparts, including lower latency for communication services, better resolution for Earth observation, and high-speed internet connectivity. As the technology matures and costs reduce, the number of LEO satellites is expected to increase significantly in the coming years.

Astranis produces microGEO communications satellites with its Omega micro GEO broadband satellite, evidence of the satcom industry’s shift to LEO. Another space startup, Rocket Lab, provides launch services for small satellites using its Electron rocket and operates its own Photon spacecraft for various missions in LEO.

Duro customer Muon Space creates, develops, and manages LEO satellite constellations for Earth intelligence missions. Other NewSpace companies are developing more affordable launch vehicles tailored for small satellites:

Astra’s Rocket 4 is designed to launch small satellites, such as CubeSats, into low Earth orbit, providing a more affordable option for small payloads. Launcher developed the E-2 liquid rocket engine which has been touted as the most powerful engine for small launches.

The emergence of VLEO (Very Low Earth Orbit)

Very Low Earth Orbit (VLEO) refers to altitudes below 450 kilometers, significantly closer to Earth than traditional Low Earth Orbit. This proximity allows satellites to capture higher-resolution imagery with smaller, more cost-effective optics, making VLEO an ideal orbit for applications requiring frequent data refresh and real-time insights.

Operating in VLEO presents challenges, including increased atmospheric drag and exposure to atomic oxygen, which can degrade satellite materials over time. Advanced propulsion systems and durable satellite designs are essential to sustain long-term operations in this environment.

EOI Space is developing the Stingray Satellite Constellation to provide ultra-high-resolution imagery and near-real-time data for defense, insurance, and disaster response. Using advanced electric propulsion, these satellites will maintain a stable five-year orbit at 250 kilometers while overcoming the high-drag conditions of VLEO. This enables frequent revisits to key locations, delivering up-to-date intelligence for critical decision-making across multiple industries.

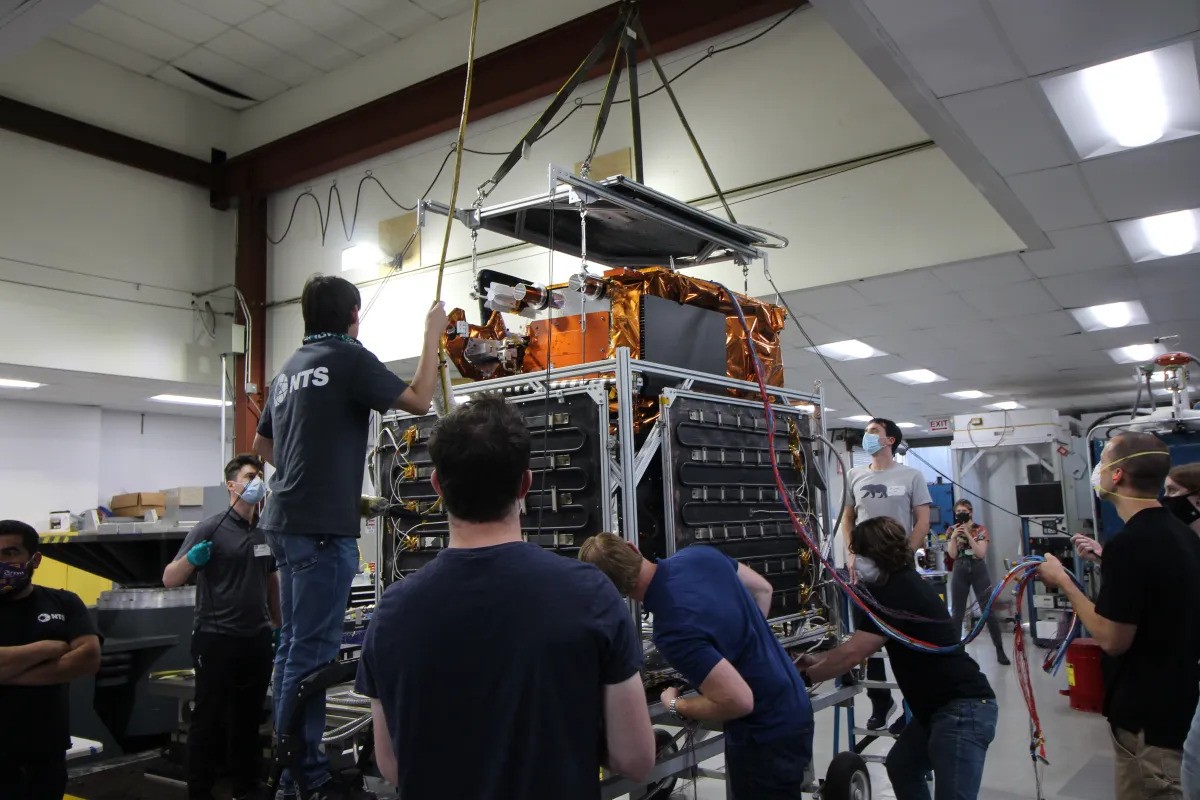

Products are now being manufactured in space

A key development in advanced space manufacturing is the shift towards in-space production applications (InSPA). This involves manufacturing products directly in the space environment rather than launching them from Earth, enabling more affordable, sustainable, and self-sufficient operations in the space environment. This approach offers several advantages:

- Reduced Launch Costs: Manufacturing in space eliminates the need to transport heavy, prefabricated components, significantly reducing launch costs and making space missions more economically viable.

- Resource Utilization: InSPA can leverage in-situ resources, such as lunar or asteroid materials, further reducing the reliance on Earth-based supplies and enabling sustainable space exploration.

- Microgravity Advantages: Utilizing space’s unique microgravity environment allows for the creation of novel materials and products with properties not achievable on Earth.

- Flexibility and Adaptability: In-space manufacturing enables on-demand production and customization, facilitating repairs, upgrades, and the construction of large-scale structures in space.

Varda Space Industries is developing technologies to enable in-space production of various products, from pharmaceuticals to spacecraft components. NASA and other space agencies are actively researching and investing in InSPA capabilities to support future space missions.

Relativity Space is transforming how rockets are built by using 3D printing for rocket production, streamlining manufacturing processes, reducing costs, and enabling rapid iteration. This could make access to space more affordable and accelerate space infrastructure development.

Increased space traffic demands collision prevention tech

The increasing volume of space traffic and debris poses a challenge to the sustainability of space activities. This congestion increases the risk of collisions and potential damage to valuable infrastructure and threatens the long-term viability of space exploration and utilization. As more satellites are launched into orbit and debris accumulates, solutions for managing this growing problem are needed.

LeoLabs is addressing these challenges head-on. LeoLabs specialize in space situational awareness, utilizing a network of radars to track objects in orbit and provide data to expand regulatory compliance by monitoring the movement of satellites and debris. LeoLabs enables operators to make informed decisions and maneuver their spacecraft to avoid potential collisions.

Duro customer Orbit Fab develops in-space refueling technology, offering another solution for mitigating the risks associated with space debris. By extending the lifespan of satellites via gas stations in space, Orbit Fab reduces the need for new launches, decreasing the overall volume of space traffic and minimizing the risk of collisions and debris generation.

Refueling can facilitate the removal of defunct satellites and debris, as service spacecraft can be replenished with fuel for extended operations. OrbitFab was recently recognized as a top-five space activity management startup.

Development of smart propulsion systems

Smart propulsion is quickly becoming a defining trend in the space industry due to its potential to increase spacecraft maneuverability, extend mission durations, and enable access to previously unreachable destinations by increasing fuel efficiency and reducing overall mass.

Stoke Space develops fully reusable launch vehicles for advanced propulsion solutions to reduce costs and make space more accessible. The company’s new full-flow, staged-combustion (FFSC) rocket engine is at the pinnacle of rocket propulsion technology due to fuel efficiency and in-flight performance.

Space missions have increased by 152% in 4 years

According to the U.S. International Trade Commission, “U.S. launches increased 152 percent from 31 in 2018 to 78 in 2022.” This increasing number of commercial and scientific space missions is driven by the growing accessibility and affordability of space technologies by innovative NewSpace companies.

However, with more space missions come more challenges, particularly delays from technical issues and developmental setbacks. James Webb Space Telescope launched over a decade late and was $6.5 billion over budget, while the Mars Sample Return and Artemis missions faced delays of at least two years and one year, respectively, with budget overruns of $6 billion and $4.3 billion, respectively.

Space mining is a solution to Earth's scare resources

The space mining industry is gaining momentum due to valuable resources like metals and water ice found on asteroids and the Moon. These resources could be used for various purposes on Earth and support future space missions. As space missions become more affordable, companies and governments invest in exploring and utilizing these resources, creating economic growth and technological progress.

By mining platinum group metals from asteroids and refining them in space, LA-based space startup Astroforge sources materials for use in space. This approach could make space missions more efficient and cost-effective by eliminating the need to transport materials from Earth. Their focus on refining metals in space could lead to self-sufficient space-based industries, supporting the expansion of human activities in space.

Growing demand for high-speed communication networks in space

Recent improvements in communication technology for space use have led to better communication methods. This is driven by the growing demand for reliable and high-speed communication networks in space, fueled by the increasing number of satellites, space exploration missions, and the rise of the commercial space industry.

Astranis is building and deploying smaller, more affordable geostationary communication satellites that provide high-speed broadband internet access to underserved regions worldwide. Their satellites leverage technologies like software-defined radios to allocate bandwidth and adapt to changing demand. Astranis’ approach is disrupting the traditional satellite communication market by offering a more cost-effective and scalable solution that can expand coverage.

Space data helps predict weather patterns

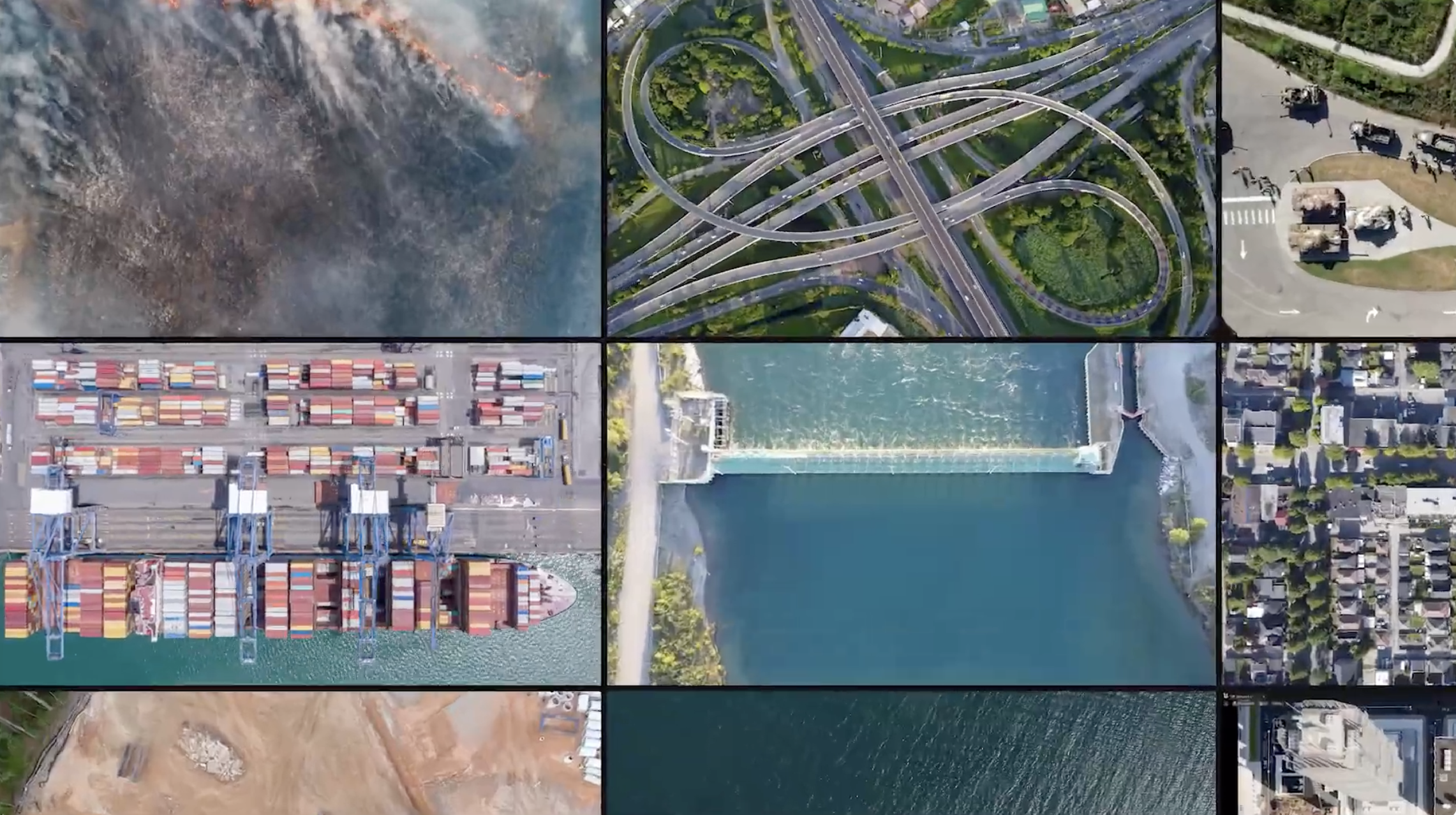

Advancements in satellite technology, decreased launch costs, and the growing NewSpace industry drive the need for space data. High-resolution imagery, precise location data, and real-time environmental monitoring are just a few capabilities now accessible through space-based assets.

These developments can transform industries from agriculture and energy to finance and insurance. The ability to monitor crop health, track asset movement, predict weather patterns, and assess risk is changing traditional decision-making and creating new opportunities.

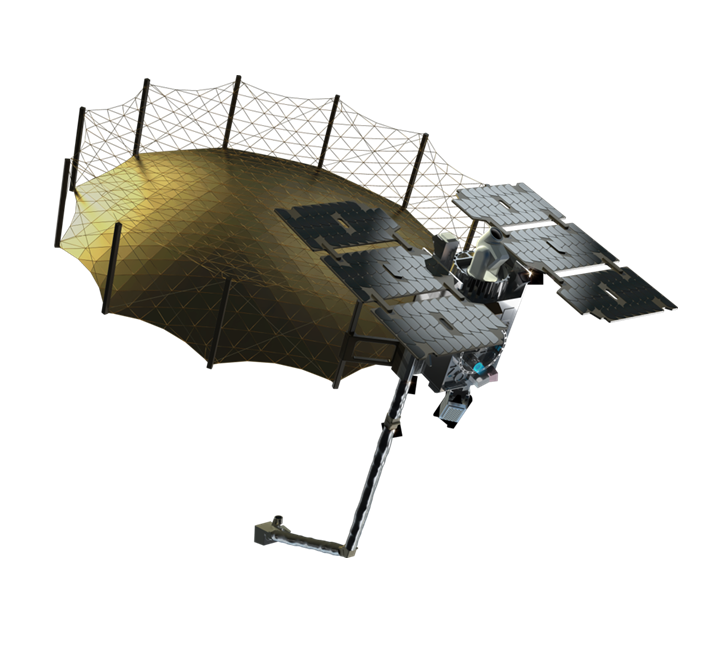

Capella Space’s advanced Synthetic Aperture Radar (SAR) satellites capture high-resolution images of the Earth’s surface 24 hours a day, producing a constant stream of data that can be used to monitor climate change and deforestation. This data can also enhance maritime safety and speed disaster response.

How aerospace trends are shaping the future of the industry

The aerospace industry is evolving, driven by the surge of NewSpace companies, a larger space workforce, and technological advancements. There are plenty of opportunities for commercial space ventures, from asteroid mining and in-space manufacturing to revolutionizing global communications and providing critical space data.

But, challenges remain, including managing space traffic, the high costs of space exploration, and the need for continued innovation to maintain a competitive edge. To continue success in the future, space startups must remain agile, embrace cutting-edge technologies like smart propulsion and in-space production, and prioritize a sustainable space ecosystem.

Aerospace companies are increasingly adopting agile PLM software to manage product development efficiently and keep up with the pace of space innovation. PLM software provides a single source of truth for engineering data, streamlines collaboration across teams, and integrates seamlessly with mission-critical tools like CAD and ERP. These capabilities enable aerospace companies to accelerate design iterations, reduce errors, and comply with stringent industry regulations such as ITAR and NIST compliance.

The aerospace industry’s future is moving towards more commercial ventures, thanks to space startups providing affordable launch options. Other industry trends could come in the shape of private space launches, increased connectivity for bigger constellations, AI diagnostics for activity management, and origami antennas. It’s an exciting time in this space, no pun intended. Stay tuned.